Let’s be real—if you’re reading this, you’ve probably had that moment where you look at your bank account and think, “Where did all my money go?” You’re not alone. Most people struggle with the gap between what they earn and what actually stays in their account at the end of the month. The good news? It’s not about being bad with money. It’s about having a system that actually works for your life.

The difference between people who feel financially stressed and those who don’t usually comes down to one thing: they know where their money is going. And honestly, that’s something you can learn to do too—probably faster than you think.

Here’s what we’re diving into today: how to actually see your money situation clearly, understand what’s really happening with your cash flow, and build a foundation that lets you make better financial decisions. No judgment, no shame, just practical steps you can start using today.

Why You Can’t Find Your Money

Here’s the thing about modern finances: your money is everywhere. It’s sitting in your checking account, your savings account, your credit card, your investment apps, maybe even in some old account you forgot about. You’ve got money coming in through direct deposit, side hustles, bonuses, and tax refunds. And it’s going out through subscriptions you forgot about, groceries, rent, insurance, that one app you downloaded three months ago.

Without a clear picture of what’s happening, your brain basically gives up trying to track it all. It’s too much information, so you just… don’t think about it. Then you’re shocked when you realize you spent $200 on coffee this month or that you’ve been paying for three different streaming services.

The first step to finding your money is understanding that this isn’t a character flaw. Your brain isn’t wired to track dozens of small transactions across multiple accounts. That’s why you need a system. And the good news? Once you build one, it actually gets easier, not harder.

The Three Money Buckets

Think of your money in three categories: money you need to spend, money you should spend, and money you could spend. This framework makes everything simpler.

The “Need” Bucket is your non-negotiables. Rent, utilities, insurance, minimum debt payments, groceries, transportation to work. These are the things that happen whether you want them to or not. For most people, this is somewhere between 50-70% of their income.

The “Should” Bucket is your future-focused spending. This is where retirement planning lives, emergency savings, paying down debt above minimums, and investing. Most financial experts suggest aiming for 20% of your income here, though honestly, starting with even 5-10% is better than nothing.

The “Could” Bucket is everything else—dining out, entertainment, hobbies, that new thing you want. This is your discretionary money, and it’s not bad or wrong to have it. You’re not supposed to live like a monk. This typically ends up being 10-30% depending on your situation.

The magic happens when you’re intentional about which bucket money goes into. Right now, you probably don’t think about buckets at all. Money just… happens. Let’s change that.

Creating a Money Map

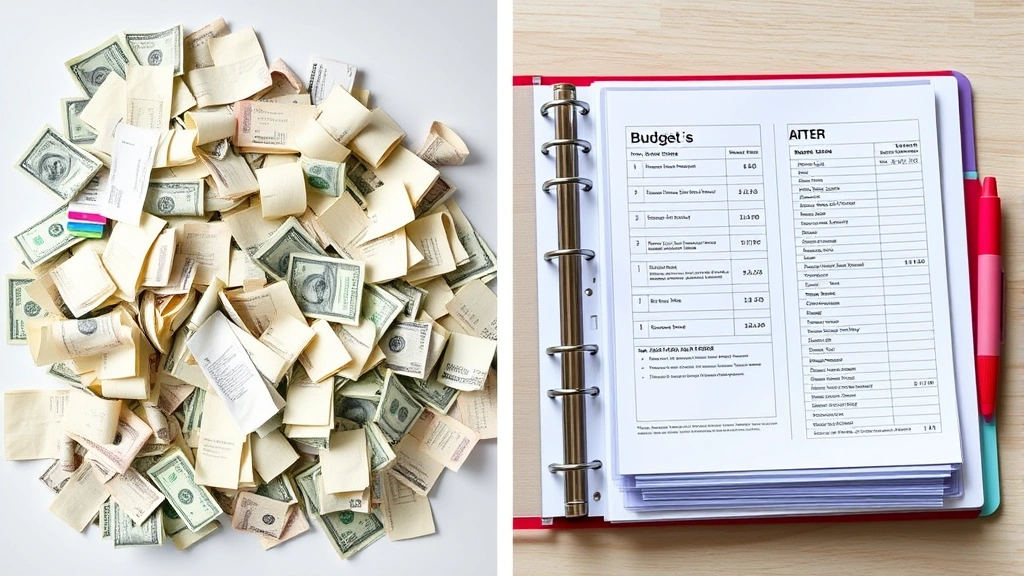

A money map is just a visual representation of where your money actually goes. You don’t need anything fancy—a spreadsheet works great, or even pen and paper if that’s your style.

Start by collecting your last three months of bank and credit card statements. Yeah, I know it feels tedious, but this is the foundation of everything. Open them up and look for patterns. What categories keep showing up? How much are you really spending on food, transportation, subscriptions, entertainment?

Create a list of every recurring expense you can find. Rent, insurance, phone bill, gym membership, Netflix, Hulu, Disney+, that meal delivery service you tried once, your coffee shop of choice. Write down the amount and the frequency. Then add up everything you spend on the big variable categories like groceries, gas, and eating out.

Here’s where it gets interesting: compare this to your actual income. What percentage of your money is going to “needs”? What percentage to “shoulds”? What’s left for “coulds”? This is your money map, and it’s probably going to show you something you didn’t expect.

If your needs are eating up 80% of your income, that’s important information. It means you either need to adjust your budgeting strategies or look at your income situation. If your “could” bucket is bigger than your “should” bucket, you’ve found a place to make a change. There’s no judgment here—you’re just getting honest about what’s actually happening.

Finding Your Money Leaks

Money leaks are the small expenses that seem insignificant individually but add up to real money over time. They’re usually the first thing that gets cut when people want to save more money because they’re the easiest to spot once you’re looking.

Go through your statements and look for subscriptions you’re not using. That gym membership you haven’t been to in six months? The meditation app you tried for two weeks? The premium version of a free service you forgot you upgraded to? These add up faster than you’d think. The average person has between $100-200 in unused subscriptions every month.

Look at your “convenience” spending. Coffee runs, food delivery, the convenience store instead of the grocery store. These aren’t bad purchases—convenience has real value. But if you’re spending $15 a day on coffee when you could make it at home for $1, that’s $280 a month you could redirect somewhere else. Over a year, that’s $3,360.

Check your impulse purchases. That thing you bought online at midnight that you’re not sure why. The clearance item that seemed like a deal even though you didn’t need it. These are harder to track because they’re one-off purchases, but if they’re happening regularly, they’re a leak.

Don’t cut everything immediately. The goal isn’t to live miserably. The goal is to be intentional. If coffee is your joy and you have the money for it, keep it. But know that’s what you’re choosing. Just make sure you’re not accidentally spending $280 a month on things you don’t actually value.

Building Your Money System

Now that you know where your money is going, it’s time to build a system that makes managing it easier. This doesn’t have to be complicated, and honestly, the simpler it is, the more likely you’ll stick with it.

The Foundation: Automate Everything You Can

Set up automatic transfers on the day you get paid. Move money for your “should” bucket first—your emergency fund, retirement contributions, debt payoff. This is the secret: pay yourself first, not last. By the time you see the money in your checking account, it’s already been allocated. This prevents the “I’ll save whatever’s left” approach that almost never works because there’s never anything left.

The Structure: Use Multiple Accounts

If your bank allows it, create separate accounts for different purposes. One for bills, one for savings, one for “could” spending. This creates a physical barrier that makes it harder to accidentally spend money you meant to save. When you see $500 in your “entertainment” account instead of $5,000 in your main account, you’re more likely to think twice before spending it.

The Tracking: Choose Your System

You need a way to track what’s happening. This could be a spreadsheet you update weekly, a budgeting app, or even a piece of paper you carry with you. The best system is the one you’ll actually use, not the one that’s theoretically perfect.

Many people find success with the pay yourself first approach, which we’ve already mentioned, but let’s be specific about it. The idea is that you decide right now how much of your income goes to savings, investments, and debt payoff. That money moves automatically before you see it. Whatever’s left is what you have to spend. This removes the willpower component entirely.

Consider looking at resources from the Consumer Financial Protection Bureau for free budgeting templates and tools. They’ve got solid, no-nonsense resources that actually help.

Tracking Tools That Actually Work

You don’t need expensive software to track your money. Here are some options, from free to premium:

- Spreadsheet (Free): Open Google Sheets or Excel and create a simple table. List your income, your fixed expenses, your variable expenses, and your savings goal. Update it weekly. It’s manual, but sometimes the act of manually entering numbers makes you more aware of what’s happening.

- Free Budgeting Apps: Apps like Bankrate’s list of budgeting apps can help you find options that connect to your bank accounts and categorize spending automatically. The trade-off is that they have access to your financial information.

- Your Bank’s Tools: Most banks have built-in budgeting features. It’s free and relatively secure since you’re not giving your information to a third party. Check what your bank offers before paying for something else.

- Envelope Method (Physical or Digital): This is an old-school approach that still works. You allocate money to different “envelopes” (categories), and once the envelope is empty, you’re done spending in that category for the month. Some apps digitize this approach.

The point isn’t finding the perfect tool. The point is starting to track. Once you have three months of data, you’ll see patterns you couldn’t see before. You’ll notice that your restaurant spending goes up on the weekends, that you spend more on groceries when you shop hungry, that your entertainment budget expands in winter.

When you understand your patterns, you can make real changes. Not because someone told you to cut back, but because you see exactly where your money is going and you get to decide if that’s how you want it to be.

A solid resource for understanding money management is Investopedia, which has comprehensive guides on everything from budgeting to investing. And if you’re dealing with debt or trying to understand credit, NerdWallet has practical, jargon-free explanations.

Once you’ve got your tracking system going, you can start thinking about bigger goals. Maybe it’s building an emergency fund so you’re not living paycheck to paycheck. Maybe it’s tackling debt payoff strategies so you’re not paying interest on old mistakes. Maybe it’s starting to invest for your future.

But none of that happens until you know where your money is. And now you do.

FAQ

How often should I review my money map?

At minimum, monthly. Many people do it weekly, which gives you real-time awareness of what’s happening. The more frequently you check in, the easier it is to catch problems early before they become big issues. Even 15 minutes a week makes a difference.

What if my “needs” bucket is bigger than 70% of my income?

That’s actually really common, especially if you’re in a high cost-of-living area or dealing with unexpected expenses. The next step is to look at whether your needs are actually needs or wants disguised as needs. Could you find cheaper housing? Is your insurance rate competitive? Are you overspending on utilities? Sometimes small changes add up. Sometimes you need a bigger change, like finding a higher-paying job or relocating. Either way, knowing the problem is the first step to solving it.

Should I use multiple bank accounts?

It helps a lot of people, but it’s not required. The key is having a system that works for you. If multiple accounts make it easier to stick to your budget, go for it. If it feels complicated, a single account with detailed tracking works too. The method matters less than the consistency.

What’s the best budgeting method?

There’s no single “best” method because everyone’s situation is different. Some people do great with the 50/30/20 rule (50% needs, 30% wants, 20% savings). Others use the envelope method or zero-based budgeting where every dollar is assigned a purpose. Try different approaches and see what sticks. The best method is the one you’ll actually follow.

How long until I see results?

You’ll probably notice something within a week just from paying attention. But real changes usually take about three months. That’s how long it takes to break old habits and see new patterns. Give yourself at least that long before deciding if your system is working.